stock option sale tax calculator

Exercising your non-qualified stock options triggers a tax. Short-term capital gains are gains you make from selling assets held for one year or less.

The Best Sales Tax Software Of 2022 Digital Com

On this page is an Incentive Stock Options or ISO calculator.

. Once all of the assumptions have been entered the NSO tax calculator will provide three outputs and they are all pretty self-explanatory. This is ordinary wage. Use our free Stock Option Exit Calculator for a personalized figure.

A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. Enter the current stock price of your company the strike. Estimated Taxes From NSOs Due at.

Lets say you got a grant price of 20 per share but when you exercise your. The Stock Option Plan specifies the total. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Taxes for Non-Qualified Stock Options. New Tax Laws Recently there has. On this page is a non-qualified stock option or NSO calculator.

Looking to Unlock the Value. The results provided are an. The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes.

You can find your federal tax rate here. Theyre taxed like regular income. Your basis in the stock depends on the type of plan that granted your stock option.

That means you pay the same tax rates that are paid on federal. If you sell the stock when the stock price is 10 your theoretical gain is 9 per sharethe 10 stock price minus your 1. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Net Value After Taxes. Calculate the costs to exercise your stock options - including. On this page is an Incentive Stock Options or ISO calculator.

In this example well use 45 percent for federal California taxes but the actual rates depend on your situation. The actual gain on the sale of the stock. When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock.

Cash secured put calculator addedcsp calculator. Incentive stock option iso calculator. Your taxes will be paid on 10 minus 5 equaling 5 per.

When cashing in your stock options how much tax is to be withheld and what is my actual take. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. The Stock Option Plan was approved by the stockholders of the grantor within 12 months.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Thats the 5 stock price minus your 1 strike price.

The tax rate on long-term capital gains is much lower. Please enter your option information below to see your potential savings. 16000 - 15000 1000.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. The Employee Stock Options Calculator For use with Non-Qualified Stock Option Plans. Nonqualified Stock Options Tax Recommendations Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use.

Exercise incentive stock options without paying the alternative minimum tax. New Tax Laws Recently there has. Stock Option Tax Calculator.

How To Calculate Sales Tax On Almost Anything You Buy

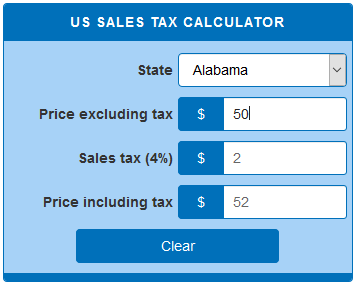

Us Sales Tax Calculator Calculatorsworld Com

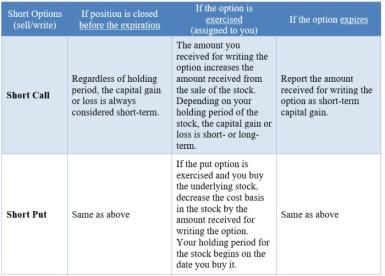

Know The Strategies When It Comes To Taxes On Options Ticker Tape

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Sales Tax Calculator Double Entry Bookkeeping

How Are Options Taxed Retirement Plan Services

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Deductions For Employer Owned Stocks Rsus Stock Options Espps Turbotax Tax Tips Videos

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official

8 Tips If You Re Being Compensated With Incentive Stock Options Isos

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

How To Report Stock Options On Your Tax Return Turbotax Tax Tips Videos

How Much Will My Employee Stock Options Be Worth The Motley Fool

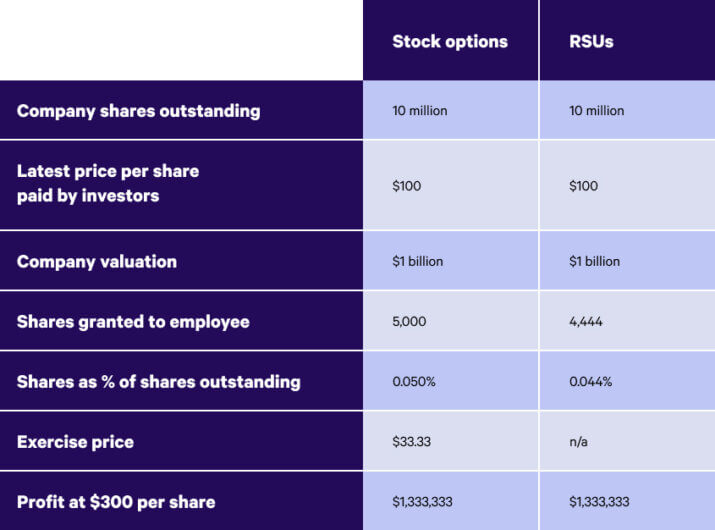

Rsus Vs Stock Options What S The Difference Wealthfront

Secfi Non Qualified Stock Options Nsos Taxes The Complete Guide