10 dollars an hour 40 hours a week after taxes

A normal year is 52 weeks and 1 day a leap year is 522. Please note these numbers are exclusive of income tax.

Avanti Gross Salary Calculator

To calculate how much you make biweekly before taxes you would multiply 10 by 40 hours and 2 weeks.

. If creating each item along with managing supply inventory interacting with customers then shipping the items takes her 2 hour then this comes to 10 per hour. If you are working a full-time job you will be working 40 hours per week on average. 1710 40 hours.

Clothing Expenses Some jobs require workers to purchase and wear uniforms and these clothing costs will further reduce a persons real hourly wage. 13 dollars an hour for 40 hours 1340 520 dollars per week. So your gross income every year would be 39520.

To calculate your yearly income before taxes you have to multiple 52 weeks by the number of hours you work per week 40 and then multiply that number by 20. This amount is calculated by assuming you work full-time for all four weeks of the month. If you make 10 an hour you will get paid 400 a week.

If I make 20304 on disability for the year and 25636 with the PUA after having 10 taken out each check filing single with dependent. The commonly cited minimum wage annual salary for a 40-hour-a. To calculate how much you make biweekly before taxes you would multiply 40 by 40 hours and 2 weeks.

40 hours multiplied by 52 weeks is 2080 working hours in a year. Child Care 40 hours of child care a week reduces a workers real hourly even further sometimes by as much as 350 an hour. 40 an Hour is How Much a Week.

An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. More information about the calculations performed. The following table shows what the pretax biweekly earnings for 20 30 40 hour work weeks for various hourly salaries.

Dec 7 2010 0502 PM If I make 1000 an hour 40 hours a week how much will I net after taxes. To calculate how much 1710 an hour is per year we first calculate weekly pay by multiplying 1710 by 40 hours per week and then we multiply the product by 52 weeks like this. Hourly rates weekly pay and bonuses are also catered for.

As a simple baseline calculation lets say you take 2 weeks off each year as unpaid vacation time. I would like to break even or owe a little at. Its not all bad news however.

If you are paid 60000 a year then divide that by 12 to get 5000 per month. Work weeks per year. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 780 after taxes.

If you know you work 40 hours a week for 50 weeks a year then you would multiply the hourly stated wage by 2000 to get the annual total then divide by 12 to get the monthly equivalent. My next question is the city Im in Im currently paying 19 federal tax at 16 before it was 22 at 1650. You can search for IRS Circular E and calculate your own taxes.

68400 52 weeks. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes. The weekly take-home pay for a 40-hour-a-week minimum-wage employee after Social Security and Medicare taxes.

By the way your W-4 counts allowances and not dependents. So if you work 50 weeks you will make 52050. How much money is 10 per hour.

In the state of Massachusetts this would be 31639 take-home salary after taxes every year. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Wild guess 320 dollars give or take depending on.

To calculate how much you make biweekly before taxes you would multiply 13 by 40 hours and 2 weeks. This is 2637 every month on average. If you are earning 19 an hour and working 40 hours every week you will be working 2080 hours every year.

If she sells about 2 items a week for 36 each spends 5 on shipping each item out has a 11 cost of goods for each item then her profit is 20 per item or 40 weekly on average. The latest budget information from April 2021 is used to show you exactly what you need to know. 10 dollars per hour working 2000 hours.

If you multiply 40 hours by 10 an hour you get 400 your weekly income. Then you would be working 50 weeks of the year and if you work a typical 40 hours a week you have a total of 2000 hours of work each year. Annual salary 3120000 Monthly salary 260000 Weekly salary 60000.

So 52 into 40 is 2080 hours per year. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. How much is 10 an hour after taxes.

If you are a single parent you could have yourself as. That adds up to 1392638 per year or just over 1150 per month. There city income tax.

13 an Hour is How Much a Week. This depends on how often you are paid and claimed marital status. 13 per hour multiplied by 2080 working hours per year is an annual income of 27040 per year.

68400 per week. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. 10 an Hour is How Much a Week.

If you make 10 per hour your Yearly salary would be 19500. All Topics Topic Science Mathematics If I make 1000 an hour 40 hours a week how much will I net after taxes. To calculate how much you will get paid per year lets assume you work 52 weeks of the year with 2 weeks paid time off.

Work hours per week. The following table lists flat monthly incomes based on a 2000 hour work year. Assuming you work 40 hours a week you would get 2 weeks of paid leave.

2080 hours into 20 is 41600 per year. This result is obtained by multiplying your base salary by the amount of hours week and months you work in a year assuming you work 375 hours a week. For example 3 days plus 4 days is 7 days which divided by 2 is 35 days in their average work week.

2 400 A Month After Tax Us March 2022 Incomeaftertax Com

Net And Gross Income 1 Financial Literacy Worksheets Budget Spreadsheet Template Budgeting Worksheets

Here S The Average Irs Tax Refund Amount By State

What Are Earnings After Tax Bdc Ca

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Printable Signs Salary

2021 2022 Tax Brackets Rates For Each Income Level

Home Office Tax Deductions Faqs Bench Accounting

Pin By Jack Paris On Seoul Korea In 2022 5 Day Work Week Criminal Background Check Teaching

Hourly Income To Annual Salary Conversion Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Employment Contract Definition What To Include Contract Template Employment Letter Of Employment

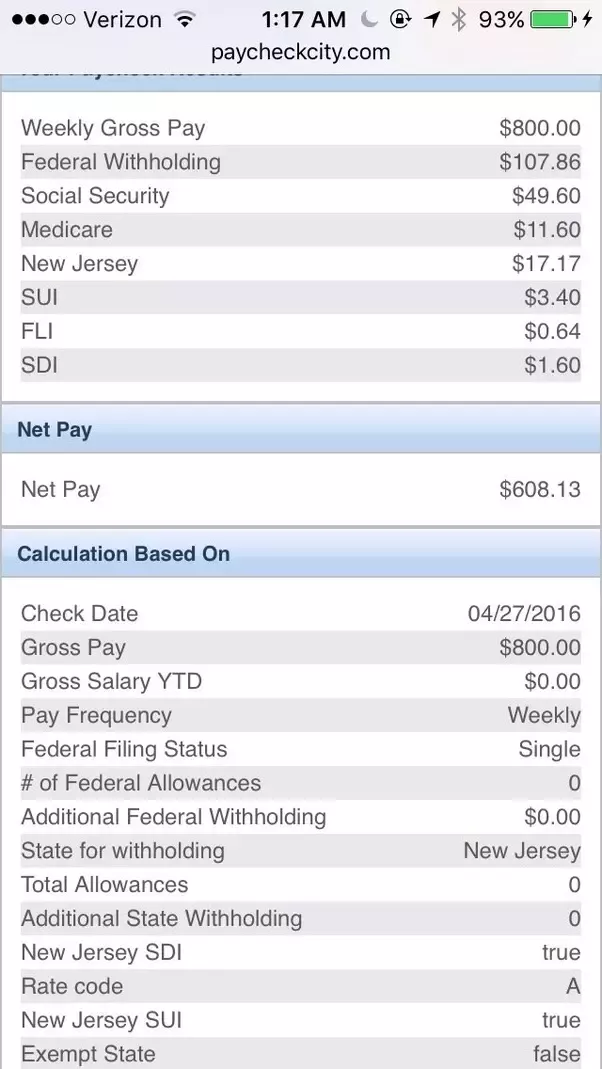

I Make 800 A Week How Much Will That Be After Taxes Quora

Income Tax Payment And Education Income Taxpe Income Tax Tax Payment Income

/https://www.thestar.com/content/dam/thestar/life/advice/2019/05/21/overtime-pay-and-the-next-tax-bracket-myth-explained/_2_turn_calculate_taxes.jpg)

Overtime Pay And The Next Tax Bracket Myth Explained The Star

California Tax Rates H R Block

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

Home Business Tax Brackets Data Entry Jobs Legit Work From Home How To Get Money